Understanding the Discharge of Mortgage Process

Steps to Successfully Discharge Your Mortgage

Discharging your mortgage is a significant milestone for homeowners in Canada. It marks the end of your mortgage obligations. This process involves several steps and requires careful attention to detail.

What Is a Discharge of Mortgage?

A discharge of mortgage is a significant milestone for homeowners. It involves the legal release of a lender’s interest in your property. This process occurs once the mortgage is fully paid off. The discharge of mortgage definition highlights two key aspects. First, it confirms the complete repayment of your home loan. Second, it ensures the removal of any claims the lender had on your property. Understanding the discharge is vital, as it marks your shift from borrower to full property owner.

Why Is Discharging a Mortgage Important?

Discharging a mortgage is crucial for homeowners eager to secure full ownership of their property. It signifies the end of financial obligations to the lender and confirms the homeowner’s sole rights. Without discharging the mortgage, the lender retains an interest in the property. This could complicate future transactions, such as selling or refinancing. Fully understanding the importance of discharge helps prevent unforeseen legal hindrances.

Discharge Fees for Home Loans in Canada

When discharging a mortgage, fees are a common expense. These fees cover the administrative work required to process the discharge. Understanding these costs is crucial for homeowners.

Lender’s Administrative Fee

This is what your bank or financial institution charges to cover their internal costs. It pays for the administrative work of preparing the discharge documents, updating their records, and officially releasing their legal claim (the lien) on your property. These fees are regulated and must be disclosed in your mortgage agreement.

$50 – $400+

Lender Fees: A Provincial Snapshot

Lender discharge fees can vary by province. Hover over the chart to see typical ranges.

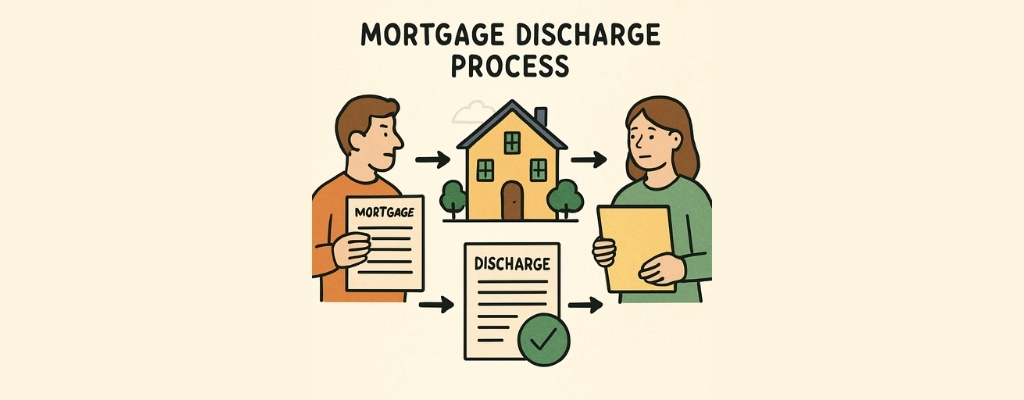

The Discharge of Mortgage Process: Step-by-Step

Completing a discharge of mortgage is a structured process. Following these steps ensures a smooth transition to full ownership.

1. Request a Mortgage Payout Statement

The journey starts with a mortgage payout statement. This crucial document outlines what you still owe on your mortgage and any applicable fees for discharging. Contact your lender to request this statement.

2. Notify Your Lender and Complete Discharge Forms

After receiving your payout statement, notify your lender of your intent to discharge. Your lender will provide specific forms. Complete these forms accurately and return them quickly to keep the process moving.

3. Pay Discharge Fees and Final Balances

Once you complete the forms, it’s time to address financial obligations. Pay the discharge fees directly to your lender and ensure any remaining balance on your mortgage is cleared.

4. Register the Discharge with the Land Registry

The last step involves registration with the land registry. This officially removes the lender’s interest. You’ll need to present the completed discharge forms. After this, your mortgage is fully discharged.

When and Why Do You Need to Discharge a Mortgage?

Discharging your mortgage is necessary when the loan is fully paid. It’s the only way to remove the lender’s legal claim from your property. Here are the key scenarios requiring a discharge.

Paying Off the Mortgage

Upon paying the final installment, homeowners often discharge the mortgage to clear the title, granting full ownership free of lender claims.

Refinancing with Another Lender

When refinancing with a new lender, discharging the existing mortgage is a prerequisite for securing new financing and a new title.

Selling the Property

To transfer a clear title to the new owner, your existing mortgage must be discharged. This is a mandatory legal step for the sale.

Provincial Differences in the Discharge Process

The mortgage discharge process varies across Canadian provinces. Each province has its unique regulations and procedures. Being aware of these differences can save time and prevent frustration.

Discharge of Mortgage in Ontario

In Ontario, discharging a mortgage requires several precise steps. Understanding these is crucial for homeowners aiming to own their property fully. The process ensures the removal of the lender’s claim. Start by requesting a discharge statement from your lender. This document details the final balance and any fees. Next, complete the necessary discharge forms with your lender’s guidance. These forms are crucial for the legal processing at the land registry office. Every detail must be accurate to avoid delays in registration.

Discharge of Mortgage in Alberta

In Alberta, discharging a mortgage involves specific provincial guidelines. Homeowners should understand these to ensure a smooth process. Legal assistance may be beneficial to navigate these requirements. The Alberta Land Titles Office handles the registration of discharges. This step is crucial to remove the lender’s claim on your property. Any errors in the documentation can lead to delays, so accuracy is vital. Working closely with your lender is recommended. They will provide the necessary forms and instructions specific to Alberta.

Frequently Asked Questions About Mortgage Discharge

Navigating the mortgage discharge process often raises questions. Getting clear answers can simplify the experience. Click on a question to reveal the answer.