Do Mortgage Brokers Charge a Fee

Do Mortgage Brokers Charge a Fee in Canada?

A comprehensive interactive guide to understanding how brokers are compensated.

Executive Summary

Navigating the world of mortgages can be daunting. One key aspect is understanding mortgage broker fees. In Canada, the compensation structure is predominantly lender-driven, meaning that for most standard mortgage applications, borrowers typically do not pay direct fees for their services. This model allows mortgage brokers to act as valuable intermediaries, connecting individuals with a diverse range of lenders and mortgage products, often leading to more favorable terms than might be secured independently.

Despite this general rule, there are specific circumstances under which a borrower may incur direct fees. These exceptions usually arise in more complex financial situations, such as when securing private mortgages, engaging with alternative or “subprime” lenders, or for borrowers with challenging credit histories. Provincial regulations enforce stringent transparency and disclosure requirements, safeguarding consumers from unexpected charges. Use the tabs below to explore how it works.

What Is a Mortgage Broker and What Do They Do?

A mortgage broker plays a vital role in the home-buying process. They act as financial matchmakers between borrowers and lenders. Their goal is to find the best mortgage terms for clients.

Mortgage brokers provide expert guidance. They analyze a client’s financial situation, including income, credit scores, and existing debts, to determine the most suitable loan products. Unlike mortgage specialists employed directly by banks, who are constrained to offering only their institution’s proprietary products, brokers possess the unique ability to survey the entire mortgage market.

Who Pays Mortgage Broker Fees?

Understanding who covers mortgage broker fees is crucial for budgeting. Payment responsibility can vary based on several factors, including location and lender practices. In Canada, the norm often sees lenders paying these fees, but it’s not a universal rule. The tabs below detail the two main scenarios.

The Standard Compensation Model: Lender-Paid Commissions

For the vast majority of conventional mortgage transactions, commonly referred to as “prime” deals, Canadian mortgage brokers receive their compensation directly from the mortgage lender, rather than from the borrower. This payment mechanism is widely recognized as a “finders’ fee” or commission, disbursed by the financial institution that ultimately funds the mortgage upon its successful closure.

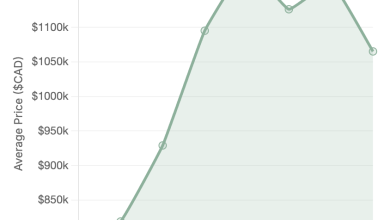

Upfront Commissions

The primary payment is a one-time commission from the lender when your mortgage is funded. These commissions typically range from 0.5% to 1.2% of the total mortgage amount. The chart on the right visualizes this range, which can vary based on the mortgage amount, term length, and product type.

Other Forms of Lender-Paid Compensation

In addition to upfront commissions, brokers may receive other forms of remuneration. Some lenders offer “trailer fees,” which are smaller, ongoing payments, often around 0.15% annually. Brokers may also earn a renewal fee and lenders frequently provide additional incentives to brokers for a substantial amount of business.

When Borrowers May Pay a Direct Fee: Exceptions and Scenarios

Direct fees are typically reserved for non-standard or more complex situations where securing a loan requires significantly more work and risk assessment. In these cases, private or alternative lenders often don’t pay broker commissions, so the broker charges the borrower a fee for their service. Click on a scenario to learn more.

Types of Mortgage Broker Fees

Mortgage broker fees can be diverse and usually depend on the broker and the complexity of the loan. Understanding these fees is important for every borrower. Typically, fees are part of your closing costs and can either be a flat rate or a percentage of your loan amount, often between 1% and 2%.

Loan Origination Fees vs. Broker Fees

- Origination Fees: Charged by lenders for processing your loan, covering tasks like application review and underwriting.

- Broker Fees: Charged by brokers for their service in finding and securing a loan for you.

Other Common Mortgage Charges

- Appraisal Fees: For assessing property value.

- Credit Report Fees: For evaluating your creditworthiness.

- Title Insurance Fees: To protect against title defects.

How Are Mortgage Broker Fees Calculated?

Mortgage broker fees often vary based on several factors, including the loan type, its complexity, the broker’s experience, and market conditions. To gain clarity, borrowers should request a detailed fee breakdown outlining each component and its calculation method. It’s also essential to consider negotiating fees with your broker. Some brokers might offer a reduction if you ask upfront. A proactive approach can lead to potential savings. You can highlight competition by mentioning that you’ve consulted other brokers or ask directly if any discounts are available.

Commercial vs. Residential Broker Fees

Understanding the differences between commercial and residential mortgage broker fees is crucial for informed property investment. Commercial mortgages often incur higher fees due to their complexity and scale. In contrast, residential mortgages typically involve more straightforward pricing. Commercial loans are more intricate, requiring specialized knowledge and extensive documentation.

Key Takeaways & Consumer Protection

Regardless of who pays, transparency is mandated by provincial regulators. You have the right to know how your broker is compensated. Here are the essential questions to ask and some common FAQs to help you stay informed.

Important Note: Some fees, like “commitment” or “application” fees charged *before* a mortgage is funded, are prohibited in certain provinces like British Columbia. Always verify with your provincial regulator if you’re unsure about a fee.

Frequently Asked Questions

Conclusion

Mortgage broker fees are an important part of the home financing process. While broker fees add to the initial expenses, they might lead to significant savings over time. Deciding whether these fees are worth it depends on individual circumstances. Ultimately, a well-chosen broker can prove to be a valuable asset in your home buying journey.