How Refinancing Affects Your Credit Score

Refinancing can save you money, but it almost always impacts your credit score. Explore this guide to understand the “dip,” the recovery, and how to protect your rating.

Select a Slice to Explore

Data based on FICO® Score models

Where Does the Impact Come From?

Your credit score is made up of five key factors. Refinancing touches nearly all of them differently. Click on the chart slices to see specifically how a refinance interacts with that factor.

Payment History (35%)

The Refinance Impact: Generally Neutral to Positive.

Refinancing essentially closes one loan and opens another. As long as you make payments on time for the new loan, your history remains strong.

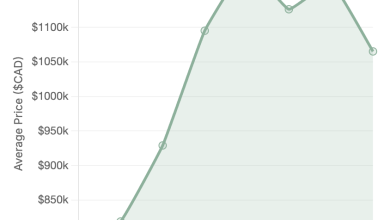

The “Refinance J-Curve”

Most borrowers see a temporary drop in their score immediately after applying. This is normal. The chart shows the typical trajectory: a dip followed by a recovery as the new loan ages.

Understanding the Dip

- 📉 Hard Inquiry: Typically costs 5-10 points per application.

- 🆕 New Account: Lowers your “Average Age of Accounts.”

Showing: One hard inquiry resulting in a minor dip and steady recovery.

Refinance Impact Simulator

Every financial situation is unique. Select your loan type and primary goal to see a tailored breakdown.

Your Scenario

Estimated Impact Report

Short Term Effect

Minor dip due to inquiry

Protect Your Score

The benefits of a lower interest rate usually outweigh the temporary credit dip. Use these strategies to minimize the damage.

The 45-Day Rule

Credit bureaus treat multiple inquiries for the same loan type (mortgage, auto) as a single inquiry if done within a 14–45 day window. Do all your rate shopping at once.

Don’t Apply Elsewhere

While refinancing, do not apply for other credit cards or loans. New applications create more hard inquiries and signal risk to lenders.

Keep Old Cards Open

If consolidating debt, don’t close the credit cards you pay off. Keeping them open maintains your credit history length and lowers your utilization ratio.

Your Path to Financial Freedom Starts Here

Whether you’re refinancing, buying your first home, or renewing, I provide expert strategies to lower your payments and protect your credit.

Strategic Mortgage Solutions

Tailored financial products designed to meet your specific life goals and current market conditions.

Refinancing

Access up to 80% of your home’s value to consolidate debt, fund renovations, or invest.

Home Purchase

Pre-approvals and expert negotiation to get you the best rate for your new dream home.

Alternative Lending

Solutions for self-employed individuals or those with bruised credit. We have options.

Your Partner in Wealth Creation

With extensive experience in the Canadian mortgage landscape, I specialize in helping homeowners leverage their property equity to achieve financial goals. I provide unbiased advice and tailored solutions that big banks simply can’t match.

Let’s Discuss Your Options

Fill out the form below to book a free, no-obligation consultation. I will analyze your current mortgage and credit situation to find the best refinancing strategy for you.