Mortgage Navigator

Is a “No Down Payment” Mortgage a Myth?

Navigating the “No Down Payment” Myth

You’ve heard about “no down payment” mortgages, but is it really possible? This guide explores the topic by first clarifying the rules in Canada, then by looking at broader financing strategies and programs from around the world. Understanding both the reality and the possibilities will help you on your path to homeownership.

The Canadian Reality: Minimum Down Payments

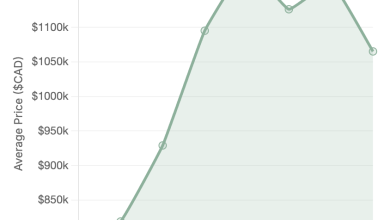

Since 2008, true zero-down-payment mortgages have been prohibited in Canada. The minimum down payment is determined by the purchase price of the home. This section will help you calculate exactly what you’ll need and explain the three types of mortgages you can expect to encounter.

The Three Mortgage Paths

In Canada, your down payment size determines your mortgage path. Understanding the three categories is key to finding the best rates.

Insured Mortgage

Down Payment: < 20%

This is mandatory when your down payment is less than 20%. The insurance protects the lender, but it allows you to buy a home sooner.

Insurable Mortgage

Down Payment: 20%+

You have 20%+ down, but your mortgage still meets all the rules for an insured one. The lender may buy insurance to get a better rate, and passes the savings to you.

Uninsured Mortgage

Down Payment: 20%+

This applies when your mortgage doesn’t meet insurance rules (e.g., home price > $1.5M, 30-year amortization, or it’s a rental property).

The 20% Tipping Point: An Interactive Case Study

A lower interest rate seems better, right? Not always. This interactive tool demonstrates the powerful, long-term financial benefit of reaching a 20% down payment. Use the slider to see how the numbers change.

Scenario 1: 19.99% Down (Insured)

Initial Mortgage

$411,251

Monthly Payment

$2,342

Insurance Premium

$11,201

Balance After 5 Yrs

$362,774

Scenario 2: 20% Down (Conventional)

Initial Mortgage

$400,000

Monthly Payment

$2,369

Insurance Premium

$0

Balance After 5 Yrs

$355,077

| 19.99% Down (Insured Mortgage) | 20% Down (Conventional/Uninsured Mortgage) | |

|---|---|---|

| Down Payment Amount | $99,950 | $100,000 |

| Mortgage Rate | 4.79% | 5.19% |

| Required Insurance Premium | $11,201 | $0 |

| Initial Mortgage Balance | $411,251 | $400,000 |

| Monthly Mortgage Payment | $2,342 | $2,369 |

| Interest Paid (5 Years) | $92,100 | $97,270 |

| Mortgage Balance After 5 Years | $362,774 | $355,077 |

After 5 years, the 20% down payment leaves you with a mortgage balance that is $7,697 lower, despite a slightly higher monthly payment. You build equity faster by avoiding the insurance premium.

Alternative Paths & Global Programs

While Canada has minimum down payment requirements, the idea of “no down payment” is often a broader term for creative financing. This section explores strategies and programs, including those from other countries, that can help you reduce your upfront costs.

These programs are designed to assist specific groups, such as veterans and low-income individuals. A significant benefit is the reduction of upfront costs. While VA and USDA loans are not available in Canada, they are prominent examples of how a no down payment strategy can be implemented in other countries.

VA Loans (For Veterans and Military)

VA loans offer substantial benefits to those who serve. They eliminate the need for a down payment and include appealing terms, such as no private mortgage insurance and competitive interest rates.

USDA Loans (For Rural and Suburban Buyers)

USDA loans support buyers in rural and some suburban areas. These loans require no down payment, easing the path to homeownership for eligible individuals with low to moderate income.

Some lenders may offer specific products or work with government incentives to reduce the down payment hurdle. Additionally, leveraging gifted funds from family or friends can be a powerful way to meet down payment requirements without personal savings.

Lender-Specific Mortgages

Private lenders, credit unions, and community banks may have flexible criteria or special promotions. They often provide more personalized options that can help you secure a mortgage with a lower-than-usual down payment.

Using Gifted Funds

Lenders typically allow gifted funds from family and friends to be used for a down payment. You will need a gift letter to verify that the money is a true gift and not a loan, which could impact your loan eligibility.

Creative solutions can help you bypass the traditional down payment model. These options require careful planning but can be a viable path to homeownership for some.

Personal Loans and Lines of Credit

Using an unsecured personal loan or line of credit can provide the funds for a down payment. Be aware that these typically have higher interest rates and add to your overall debt load.

Rent-to-Own Agreements

This strategy allows you to rent a home with an option to purchase it later. A portion of your rent goes towards the down payment, giving you time to save and build your finances.

Shared Equity and Co-Buying

By partnering with friends, family, or investors, you can split the costs of buying a home. This reduces your personal financial burden but requires a formal agreement to outline all terms and responsibilities.

Your Homebuyer Toolkit

Regardless of the path you choose, having a solid financial foundation is key. This toolkit summarizes the programs and factors that will help you on your homebuying journey.

The best of both an RRSP and a TFSA. Your contributions are tax-deductible (like an RRSP), and your withdrawals to buy a first home are tax-free (like a TFSA). You can contribute up to $8,000 per year, with a lifetime limit of $40,000.

This long-standing program allows you to withdraw up to $60,000 from your Registered Retirement Savings Plan (RRSP) tax-free to use for a down payment. You must repay the amount to your RRSP over a 15-year period.

Most provinces, and some cities, charge a tax when you buy property. First-time homebuyers are often eligible for a significant rebate on this tax, which reduces your closing costs.