Refinancing Your

Ontario Mortgage

A Comprehensive Strategic Analysis for the 2026 Fiscal Landscape.

Deep-dive research on equity extraction, IRD math, and long-term solvency.

Market Pulse 2026

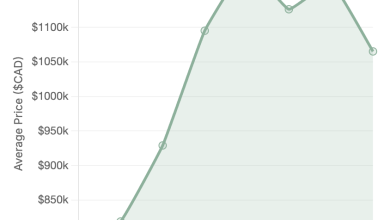

The “Great Renewal” Peak

Approximately 60% of all outstanding mortgages in Canada are scheduled for renegotiation between 2025 and 2026.

A Comprehensive Strategic Analysis

The 2026 Fiscal Landscape

The residential mortgage market in Ontario has undergone a profound transformation as it enters the mid-2020s, shifting from a period of historical volatility to one of stabilized yet elevated interest rates. For homeowners and financial professionals associated with platforms such as mortgage724.ca, the decision to refinance an existing mortgage contract is no longer a simple administrative adjustment but a complex tactical maneuver.

Refinancing is fundamentally defined as the process of breaking an existing mortgage agreement before its maturity date to establish a new loan under different terms, rates, or amortization structures. The demographic shift of the “Great Renewal” is creating unprecedented demand as borrowers face a transition from 2021 lows to a stabilized commercial prime rate of 4.45%.

Mechanism & Eligibility

Qualification Standards

Under federal and provincial guidelines, a homeowner can typically refinance up to 80% of the appraised value of their property. The qualification process mirrors the rigor of an initial application, focusing on the 20% equity buffer and debt-service ratios.

LTV Limit

Equity Buffer

Stress Test Requirement

Greater of Contract + 2% or 5.25%

Strategic Advantages

The “Pros” Narrative

Interest Rate Arbitrage

Consolidate high-interest unsecured debt (19.99% – 24.99%) into mortgage rates at 4.5%. This is an exercise in wealth preservation through interest savings.

Capital Extraction

Tap into Ontario’s property appreciation Reservoir. Use “Cash-out” for home improvements, education funding, or reinvestment in secondary rental suites.

Structural Optimization

Align the mortgage with your life stage. Shorter amortization to eliminate debt faster, or extended terms to improve immediate liquidity.

The “Cons” Narrative

Mathematical Complexity of Prepayment Penalties

The most significant barrier in Ontario is the Interest Rate Differential (IRD). Lenders use complex formulas based on “Posted Rates” which often result in penalties as high as $30,000 for mid-sized mortgages.

Refinancing can “restart the clock” on amortization, potentially leading to “equity stagnation” despite consistent payments.

IRD Inflation

Big Five banks use “posted rates” vs “discounted rates” to maximize penalty extraction.

Amortization Reset

Moving from year 5 of 25 to a new year 1 of 25 adds 5 years of high-interest debt.

Closing Costs

Administrative, Legal, and Appraisal fees typically range from 1% to 3%.

Refinance Savings Engine

Break-Even Point

17 Months

Forward Analysis

Economic Outlook 2026

Interest Rate Plateau

The Bank of Canada overnight rate is holding at 2.25%, considered a “neutral range.” Major institutions expect this stability through mid-2026.

Trade Factors (CUSMA)

The June 2026 review of CUSMA suggests that predictable rates have ended; geopolitical shocks may force reactionary adjustments.

The “Lock-in Effect”

Pandemic-era low rates are expiring, making refinancing a necessary tool to manage resulting payment increases.

Strategic Preparedness

Documentation Checklist

01 Identification

- • Valid Passport / Driver’s License

- • List of Assets (Savings, RRSPs)

- • List of Liabilities (Car Loans, CC)

02 Income (Salaried)

- • Employment Letter

- • Most Recent Pay Stubs

- • Notices of Assessment (NOA)

03 Property Detail

- • Current Mortgage Statement

- • Property Tax Bill

- • Homeowner’s Insurance Policy

Alireza Asgarian

Ontario Mortgage Agent Level 2 | 8Twelve Mortgage

“In the 2026 Ontario market, refinancing is no longer an administrative adjustment—it is a mathematical exercise in capital preservation. My objective is to provide homeowners with the clarity needed to navigate the single most significant financial asset in their portfolio: their home.”

Deep Knowledge

Refinance Intelligence FAQ

How do Level 1 vs Level 2 agents differ?

What is the “Posted Rate” penalty trap?

Request Your

2026 Analysis

Don’t navigate the complex IRD math alone. Get a licensed suitability assessment for your Ontario home equity strategy.